Are sports cards the future of retail investing?

The past decade has been a transformational one in financial services. The days of visiting a physical bank to open an account or apply for a loan are behind us — we now expect to do everything via website or app. The landscape of consumer-facing brands has also changed rapidly, with startups like Chime and Robinhood taking meaningful market share from incumbents.

This evolution has been particularly noticeable in investing. Retail investors are more empowered than ever, as we’ve seen in the past few weeks with GameStop, Bitcoin, and Dogecoin. And this goes far beyond public equities and crypto — barriers to entry have disappeared across asset classes.

We’ve seen three waves of fintech products that democratize investing:

- Phase 1: Better UX for trading public assets. Consumers could trade stocks and crypto before, but these companies made it easier and cheaper with features like zero commission trades, mobile apps, and fractional shares. Robinhood and Coinbase are the two best examples of this.

- Phase 2: Make private assets publicly tradable. These companies take assets that were privately owned and make it possible for anyone to buy shares. The platform is responsible for selecting, vetting, and storing the assets. Rally Rd., Otis Wealth, and Mythic Markets are examples of this.

- Phase 3: P2P digital trading of private assets. We’re in the early innings of this! These are companies enable consumers to digitally trade private assets between themselves, with the platform playing a supporting role. Examples include StarStock (sports cards), Quidd (fandom items), and Foundation & Zora (NFTs, which are basically crypto-powered collectibles — this deserves its own post, but check out CoinDesk’s primer).

Phase 3 is particularly exciting — these companies can function as true marketplaces with relatively little interference. The platform doesn’t have to acquire and IPO the assets, so the transaction volume should theoretically scale more quickly with better margins and strong network effects.

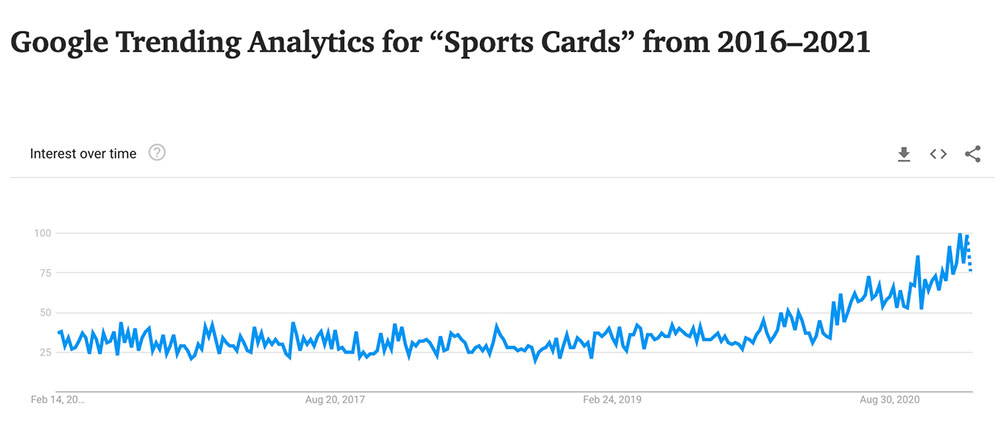

We’ll explore what this looks like through the lens of an asset class that’s breaking out — sports cards!

Read the complete article here.

Recent Posts

-

A Record-Breaking $12.9 Million: Kobe Bryant & Michael Jordan Logoman Autographs

Baseball cards have long dominated the debate of the most valuable sports cards, particularly the 19

-

AA Mint Cards Becomes a Prestigious Upper Deck Authorized Internet Retailer

Upper Deck named AA Mint Cards an Authorized Internet Retailer (AIR) in April 2025. AA Mint Cards be

-

Paul Skenes MLB Debut Patch Autograph Sells For $1.11 Million

Paul Skenes’ 1/1 Rookie Debut Patch Autograph sold for $1.11 million in an auction with Fanatics Col